27 November 2019 Afternoon Session Analysis

Kiwi rose following upbeat trade balance.

The New Zealand Kiwi which traded against the greenback rose during late Asian session following the release of its regional trade balance data. According to New Zealand Statistics, trade balance in New Zealand which measure the differences between import and export have improved to -1,013M for the month of October, slightly better than market expectation of -1,621M. Besides that, the pair also benefited from the positive comments of Financial Stability Report. According to the report, Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr emphasized that a few large banks having access to their offshore funding is “something we have to watch” and will be working closely to alter the Loan to Value Ratio (LVR) if needed. Thus, the optimism in data and the report continue to extend the rally of the New Zealand kiwi while investors now awaiting further confirmation. At the time of writing, pair of NZD/USD climbs 0.06% to 0.6425.

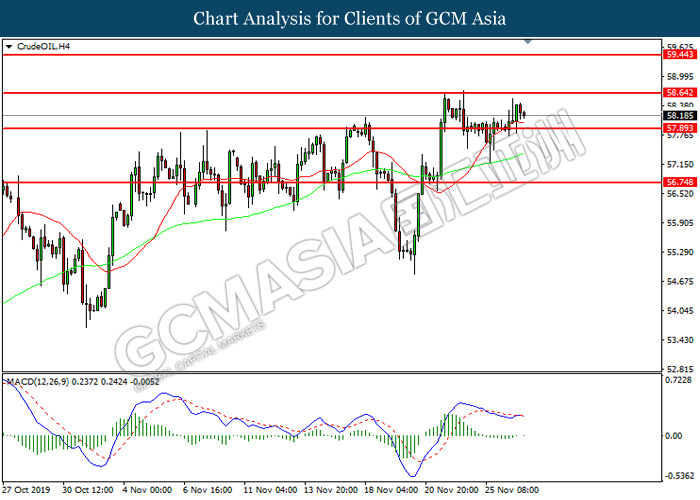

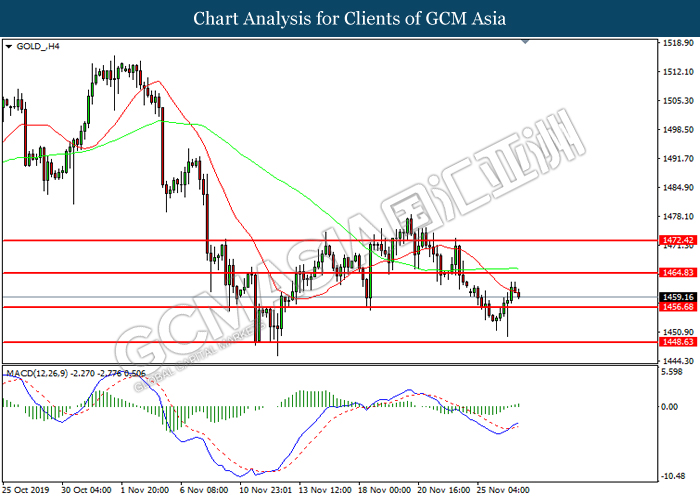

In the commodities market, crude oil price slips 0.21% to $58.13 per barrel at the time of writing as the disappointing figures from crude inventories continue to pressure the sentiment. However, the losses were capped by optimism around the signing of the first phase of a U.S.-China trade deal. On the other hand, gold price rose 0.09% to $1460.15 as of writing following ongoing trade optimism that continue to drag the commodity’s price.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative GBP BoE MPC Treasury Committee Hearings

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Oct) | -0.4% | 0.2% | – |

| 21:30 | USD – GDP (QoQ) (Q3) | 2.0% | 1.9% | – |

| 23:00 | USD – Pending Home Sales (MoM) (Oct) | 1.5% | 0.2% | – |

| 23:30 | USD – Crude Oil Inventories | 1.379M | -0.418M | – |

Technical Analysis

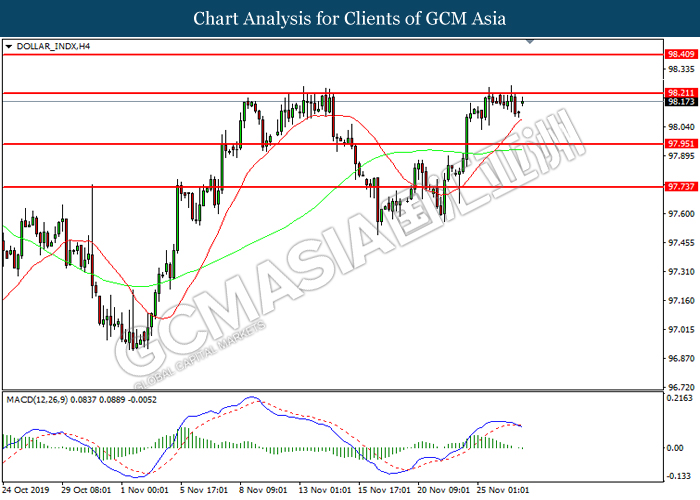

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 98.20. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level at 97.95.

Resistance level: 98.20, 98.40

Support level: 97.95, 97.75

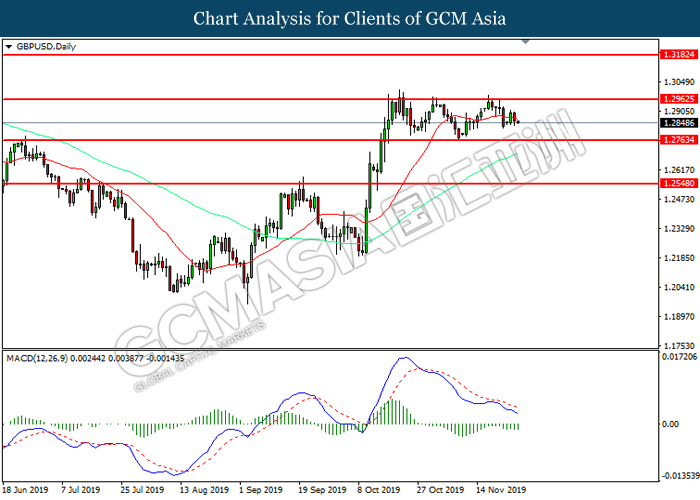

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.2965. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.2765.

Resistance level: 1.2965, 1.3180

Support level: 1.2765, 1.2550

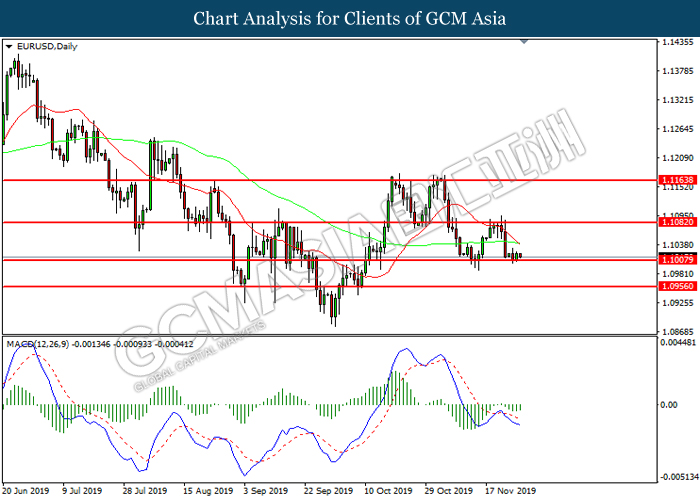

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.1010. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1080, 1.1165

Support level: 1.1010, 1.0955

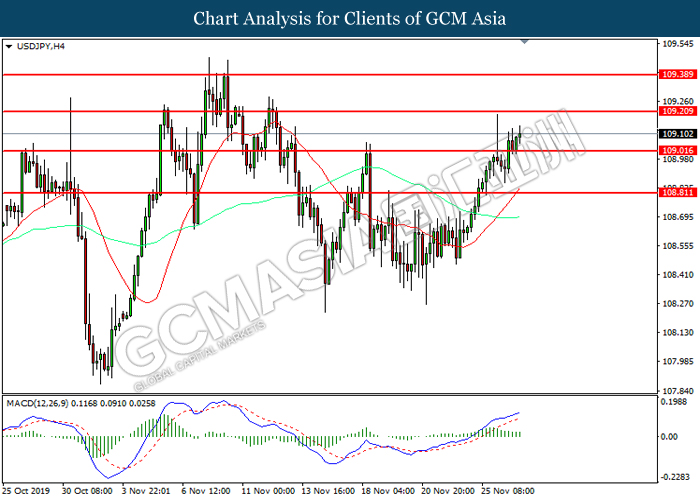

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level at 109.00. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 109.20.

Resistance level: 109.20, 109.40

Support level: 109.00, 108.80

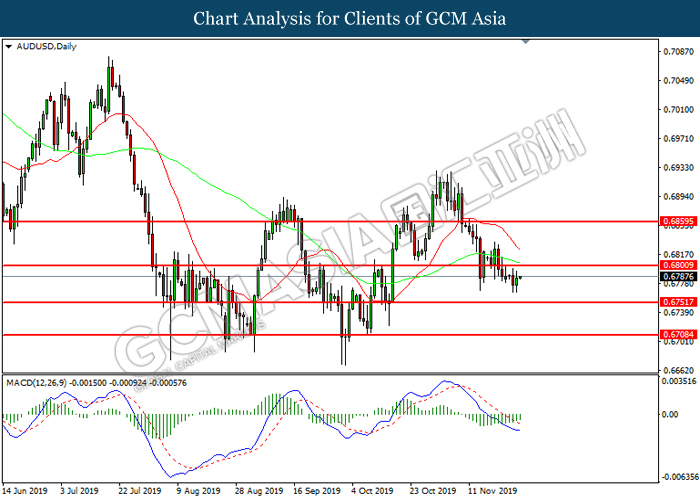

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6800. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6800, 0.6860

Support level: 0.6750, 0.6710

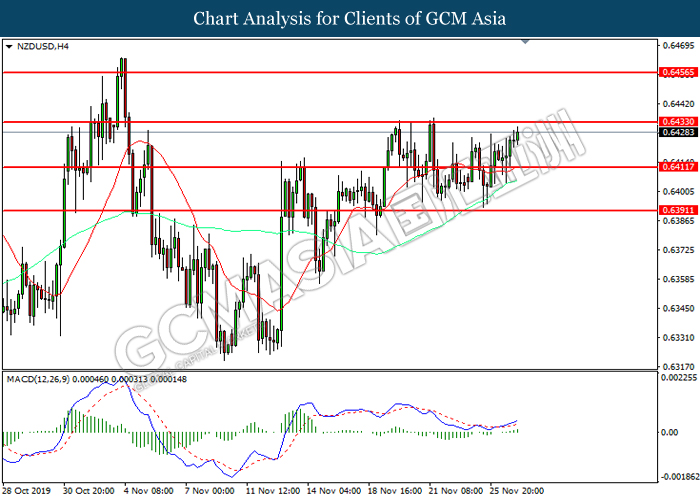

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6410. MACD which illustrate increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6435.

Resistance level: 0.6435, 0.6455

Support level: 0.6410, 0.6390

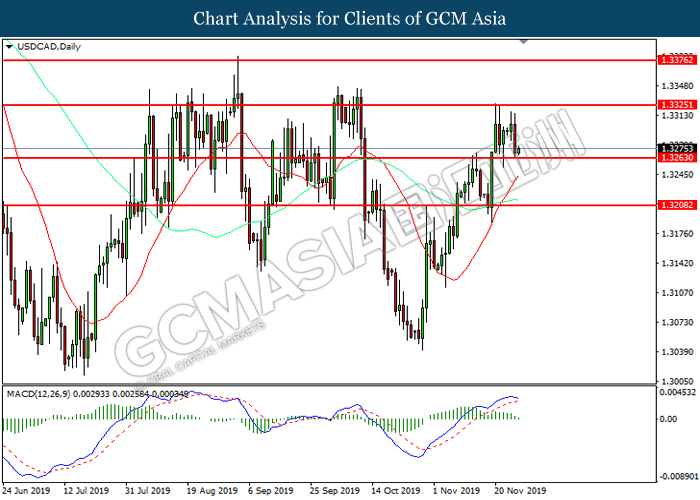

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3325. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.3265

Resistance level: 1.3325, 1.3375

Support level: 1.3265, 1.3210

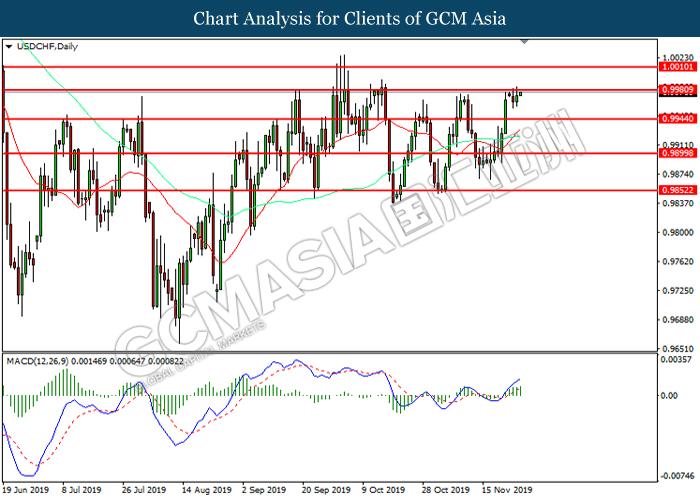

USDCHF, Daily: USDCAD was traded higher while currently testing the resistance level at 0.9980. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9980, 1.0010

Support level: 0.9945, 0.9900

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 58.65. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 58.65, 59.45

Support level: 57.90, 56.75

GOLD_, H4: Gold price was traded lower following prior retracement from the 20 MA line (Red). However, MACD which illustrated increasing bullish momentum suggest its price to be traded higher in short-term as technical correction.

Resistance level: 1464.85, 1472.40

Support level: 1456.70. 1448.65